DSP small cap fund

While the markets are down there is a lot of interest from investors to select which is the right fund for them to invest in. Retail investors often tend to get excited about investing in small cap mutual funds. It's a tiring task to select the best small cap mutual fund specially when there are a lot of option available in the market.

Out of many options DSP small cap fund is quite a popular choice among investors. Lets look at how good is DSP small cap fund and whether it makes sense to invest in DSP small cap fund.

The DSP small cap fund is also known as DSP micro cap fund.

DSP small cap fund invest philosophy

According to DSP Mutual fund website , the main objective of DSP small cap fund is as below:-

- Gives investors access to market inefficiencies

- Large pool of varied, uncorrelated stocks

- Niche plays that reduce correlation among stocks

- Niche plays that reduce correlation with broader markets

- Under owned & Under researched stocks

- Consistent track record in equity stock and sector selection

DSP small cap fund history and past performance

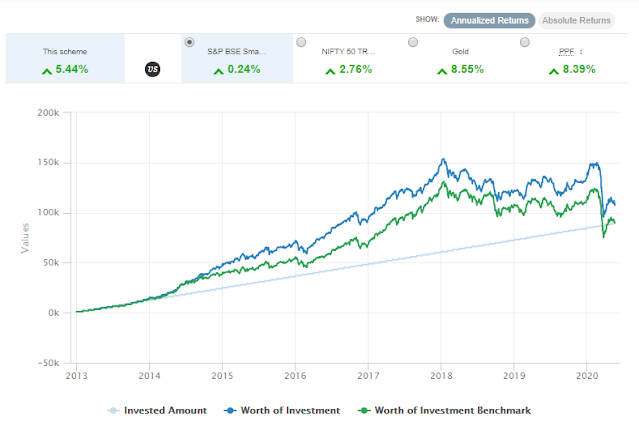

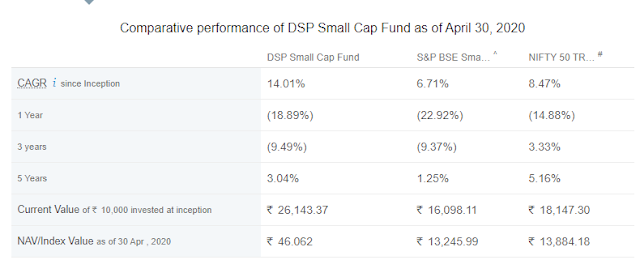

DSP small cap fund was launched on Jan 1st 2013. Since inception the DSP small cap fund has consistently beaten the S&P BSE small cap index by giving an annualized returns of 5.44%(as of 20th May 2020).

The DSP small cap fund managers - Vinit Sambre, Resham Jain, Jay Kothari

The performance of the DSP small cap fund since inception is as below

DSP small cap fund scheme details as of 30-04-2020

DSP small cap fund Expense ratio - 1.10%

Min SIP amount - ₹ 500

Min investment amount (one time- first time) - ₹500

Min investment amount (addtional purchase) - ₹500

Type : Open Ended Fund. You can invest any time in this fund.

The DSP small cap fund had stopped taking lump sum investment from 2018 until recently in April 2020. Investors now can invest in this DSP small cap fund in lump sum.

DSP small cap fund portfolio as of 30-04-2020

The DSP small cap fund has 71 stocks in its portfolio. Below are the details of complete holding!

| Stock Invested in | Sector | Value(Mn) | % of Total Holdings |

| Ipca Laboratories Ltd. | Pharmaceuticals | 3084.2 | 7.76% |

| Atul Ltd. | Chemicals - speciality | 2484.5 | 6.25% |

| Manappuram Finance Ltd. | Nbfc | 1366.8 | 3.44% |

| APL Apollo Tubes Ltd. | Steel products | 1158.2 | 2.92% |

| Nilkamal Ltd. | Plastic products | 1142.4 | 2.88% |

| J.b. Chemicals & Pharmaceuticals Ltd. | Pharmaceuticals | 1082.7 | 2.73% |

| Ratnamani Metals & Tubes Ltd. | Steel products | 1037.5 | 2.61% |

| Tube Investments Of India Ltd. | Auto ancillaries | 956.3 | 2.41% |

| Cera Sanitaryware Ltd. | Sanitary ware | 933.3 | 2.35% |

| Finolex Cables Ltd. | Cables - electricals | 895.2 | 2.25% |

| DCB Bank Ltd. | Banks | 857.1 | 2.16% |

| SRF Ltd. | Chemicals - speciality | 816.9 | 2.06% |

| Sheela Foam Ltd. | Houseware | 770.2 | 1.94% |

| Finolex Industries Ltd. | Plastic products | 764.9 | 1.93% |

| La-Opala RG Ltd. | Glass – consumer | 758.9 | 1.91% |

| Dhanuka Agritech Ltd. | Pesticides and agrochemicals | 723.5 | 1.82% |

| K.P.R. Mill Ltd. | Fabrics and garments | 720.5 | 1.81% |

| Chambal Fertilizers & Chemicals Ltd. | Fertilisers-composite | 711.6 | 1.79% |

| Swaraj Engines Ltd. | Diesel engines | 704.4 | 1.77% |

| Suprajit Engineering Ltd. | Auto ancillaries | 659.9 | 1.66% |

| Navin Flourine International Ltd. | Chemicals - inorganic | 652.6 | 1.64% |

| Vst Industries Ltd. | Cigarettes | 617.8 | 1.55% |

| Aarti Drugs Ltd. | Pharmaceuticals | 613.4 | 1.54% |

| Kajaria Ceramics Ltd. | Sanitary ware | 552.8 | 1.39% |

| Welspun India Ltd. | Fabrics and garments | 550.4 | 1.39% |

| Kalpataru Power Transmission Ltd. | Transmission towers | 512.4 | 1.29% |

| GHCL Ltd. | Chemicals - inorganic | 505.3 | 1.27% |

| Westlife Development Ltd. | Hotels/resorts | 504.1 | 1.27% |

| Vardhman Textiles Ltd. | Spinning-cotton/blended | 487.5 | 1.23% |

| Siyaram Silk Mills Ltd. | Fabrics and garments | 470.8 | 1.18% |

| INOX Leisure Ltd. | Flim production, distribution & exhibition | 456.2 | 1.15% |

| Shoppers Stop Limited | Retailing | 453 | 1.14% |

| - Narayana Hrudayalaya Ltd. | Hospital | 427.1 | 1.08% |

| Amber Enterprises India Ltd. | Air conditioner | 425.8 | 1.07% |

| Subros Ltd. | Auto ancillaries | 389.6 | 0.98% |

| Star Cement Ltd. | Cement products | 389.6 | 0.98% |

| Sharda Cropchem Ltd. | Pesticides and agrochemicals | 382.8 | 0.96% |

| Techno Electric & Engineering Co. Ltd. | Engineering, designing, construction | 368.1 | 0.93% |

| Voltamp Transformers Ltd. | Power equipment | 363.4 | 0.91% |

| Mold-Tek Packaging Ltd. | Packaging | 351 | 0.88% |

| KNR Constructions | Construction civil | 342.9 | 0.86% |

| Amrutanjan Health Care Ltd. | Pharmaceuticals | 330.8 | 0.83% |

| TTK Prestige Ltd. | Houseware | 313.6 | 0.79% |

| Muthoot Capital Services Ltd. | Nbfc | 295.3 | 0.74% |

| Triveni Engineering & Industries Ltd. | Sugar | 290.2 | 0.73% |

| LT Foods Ltd. | Consumer food | 282.7 | 0.71% |

| Prism Johnson Ltd. | Sanitary ware | 268.5 | 0.68% |

| Varroc Engineering Pvt Ltd. | Auto ancillaries | 261.3 | 0.66% |

| Equitas Holdings Ltd. | Investment companies | 255.6 | 0.64% |

| Kirloskar Ferrous Industries Ltd. | Pig iron | 252 | 0.63% |

| eClerx Services Ltd. | It enabled services – software | 245.9 | 0.62% |

| Majesco Ltd. | It enabled services – software | 225.2 | 0.57% |

| Triveni Turbine Ltd. | Power equipment | 217.4 | 0.55% |

| Kalyani Steels Ltd. | Steel | 214.6 | 0.54% |

| Repco Home Finance Ltd. | Housing finance | 211.1 | 0.53% |

| Lumax Auto Technologies Ltd. | Auto ancillaries | 199.3 | 0.50% |

| Sterlite Technologies Ltd. | Telecom - cables | 196.8 | 0.50% |

| Dixon Technologies (India) Ltd. | Consumer elctronics | 194.4 | 0.49% |

| Sandhar Technologies Ltd. | Auto ancillaries | 174.3 | 0.44% |

| Srikalahasthi Pipes Ltd. | Pig iron | 158 | 0.40% |

| Himatsingka Seide Ltd. | Fabrics and garments | 151.8 | 0.38% |

| Dwarikesh Sugar Industries Ltd. | Sugar | 114 | 0.29% |

| SP Apparels Ltd. | Fabrics and garments | 94 | 0.24% |

| UFO Moviez India Ltd. | Flim production, distribution & exhibition | 90.9 | 0.23% |

| Vardhman Special Steels Ltd. | Steel products | 81.4 | 0.20% |

| Plastiblends India Ltd. | Plastic products | 76.3 | 0.19% |

| Fiem Industries Ltd. | Auto ancillaries | 75.7 | 0.19% |

| IFGL Refractories Limited | Refractories | 68.6 | 0.17% |

| Oriental Carbon and Chemicals Ltd. | Chemicals - inorganic | 63.7 | 0.16% |

| Aarti Surfactants Ltd. | Chemicals - speciality | 51.8 | 0.13% |

| Greenlam Industries Ltd. | Plywood boards | 18.9 | 0.05% |

From above you can see the biggest holdings of DSP small cap fund is Pharma and Chemicals. After the COVID-19 issue it is believed that the pharma stocks will perform well in the market. Also, it's believed that a lot of chemical demand is going to shift from China to India because of COVID-19.

So DSP small cap fund has got its priority right in selecting the right sectors for investments.

Positive factor of DSP small cap fund portfolio :- Fund has correct allocation of Pharma and Chemical companies in its portfolio.

Negative factor of DSP small cap fund portfolio :- Fund has 71 stocks in its portfolio, after the main allocations you can see the DSP small cap fund has invested in way too many companies.

Should you invest in DSP small cap fund?

What is good about DSP small cap fund :-

Based on above analysis it looks like that the fund has got decent allocations into the sectors which are going to perform well in future.

The historical returns also shows that the DSP small cap fund was able to beat the benchmark index always.

What is bad about DSP small cap fund :-

The DSP small cap fund has higher expense ration(1.10%) which higher than the category average of 0.94%.

The DSP small cap fund also has got too many stocks in its portfolio.

Based on above facts we think that the DSP small cap fund is a good choice for risk averse investors who are willing to take risk and invest in small cap companies.

Funds similar to DSP small cap fund

Below are some small cap funds which have similar investment principle as the DSP small cap fund for investors to choose from:-

| Scheme Name | AuM (Cr) |

| Nippon India Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 6,994.88 |

| HDFC Small Cap Fund - Direct Plan - Growth Small Cap Fund | 6,834.98 |

| Franklin India Smaller Companies Fund - Direct - GrowthSmall Cap Fund | 4,900.37 |

| L&T Emerging Businesses Fund - Direct Plan - GrowthSmall Cap Fund | 4,267.86 |

| DSP Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 3,973.08 |

| SBI Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 3,280.30 |

| Axis Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 2,169.10 |

| Aditya Birla Sun Life Small cap Fund - Direct Plan - GrowthSmall Cap Fund | 1,651.11 |

| Kotak Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 1,318.02 |

| ICICI Prudential Smallcap Fund - Direct Plan - GrowthSmall Cap Fund | 982.01 |

| Sundaram Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 833.51 |

| Tata Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 519.19 |

| IDFC Emerging Businesses Fund - Direct Plan - GrowthSmall Cap Fund | 509.00 |

| Invesco India Smallcap Fund - Direct - GrowthSmall Cap Fund | 495.62 |

| Edelweiss Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 423.25 |

| Canara Robeco Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 336.69 |

| Union Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 281.41 |

| HSBC Small Cap Equity Fund - Direct Plan - GrowthSmall Cap Fund | 268.92 |

| ITI Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 175.93 |

| Principal Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 151.67 |

| Sundaram Emerging Small Cap - Series 2 - Direct Plan - GrowthSmall Cap Fund | 122.27 |

| Sundaram Emerging Small Cap - Series 1 - Direct Plan - GrowthSmall Cap Fund | 112.29 |

| Sundaram Emerging Small Cap - Series 3 - Direct Plan - GrowthSmall Cap Fund | 106.93 |

| IDBI Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 97.02 |

| Sundaram Select Micro Cap - Series XIV - Direct Plan - GrowthSmall Cap Fund | 79.63 |

| Sundaram Emerging Small Cap - Series 4 - Direct Plan - GrowthSmall Cap Fund | 78.32 |

| Sundaram Select Micro Cap - Series XV - Direct Plan - GrowthSmall Cap Fund | 77.18 |

| Sundaram Select Micro Cap - Series VIII - Direct Plan - GrowthSmall Cap Fund | 76.67 |

| Sundaram Select Small Cap - Series V - Direct Plan - GrowthSmall Cap Fund | 69.54 |

| Sundaram Select Micro Cap - Series XI - Direct Plan - GrowthSmall Cap Fund | 65.86 |

| Sundaram Emerging Small Cap - Series 7 - Direct Plan - GrowthSmall Cap Fund | 61.33 |

| BOI AXA Small Cap Fund - Direct Plan - GrowthSmall Cap Fund | 51.57 |

| Sundaram Select Micro Cap - Series XII - Direct Plan - GrowthSmall Cap Fund | 47.87 |

| Sundaram Select Micro Cap - Series IX - Direct Plan - GrowthSmall Cap Fund | 45.20 |

| Sundaram Select Micro Cap - Series XVII - Direct Plan - GrowthSmall Cap Fund | 41.07 |

| Sundaram Select Small Cap - Series VI - Direct Plan - GrowthSmall Cap Fund | 30.48 |

| Sundaram Emerging Small Cap - Series 5 - Direct Plan - GrowthSmall Cap Fund | 29.34 |

| Sundaram Select Micro Cap - Series X - Direct Plan - GrowthSmall Cap Fund | 28.74 |

| Sundaram Emerging Small Cap - Series 6 - Direct Plan - GrowthSmall Cap Fund | 15.56 |

| Quant Small Cap - Direct Plan - GrowthSmall Cap Fund | 1.77 |

Disclaimer- Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Comments

Post a Comment